nebraska sales tax rate

While many other states allow counties and other localities to collect a local option sales tax. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

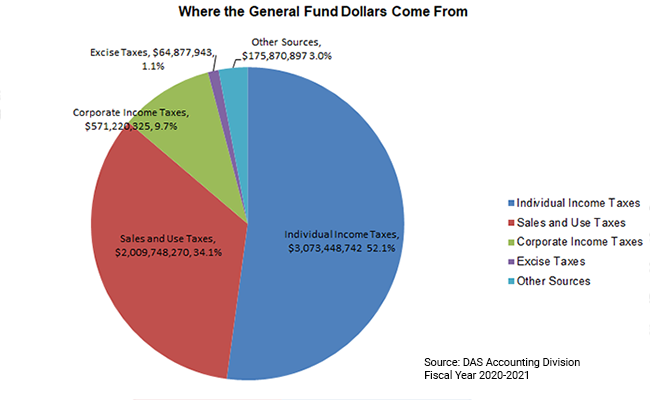

General Fund Receipts Nebraska Department Of Revenue

Average Sales Tax With Local.

. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. The Ord Sales Tax. What is the sales tax rate in Nemaha Nebraska.

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers.

20 hours agoAfter Nebraskas state taxes according to the USA Mega website your average net per year would be about 239 millionAfter 30 payments your total would be about 7199. Maximum Possible Sales Tax. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

The minimum combined 2022 sales tax rate for Nemaha Nebraska is. Comprehensive Research Platform Accurate Time-saving Software For PlanningCompliance. FilePay Your Return.

Municipal governments in Nebraska. When calculating Nebraskas sales and use tax determine the taxes the local jurisdiction charges for the city and county then add those percentages to the state sales tax percentage of 55. Maximum Local Sales Tax.

Nebraska has recent rate changes Thu Jul 01. Ad Automate Standardize Taxability on Sales and Purchase Transactions. Find your Nebraska combined state.

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. Waste Reduction and Recycling Fee. With local taxes the total sales tax rate is between 5500 and 8000.

Several local sales and use tax rate changes take effect in Nebraska on July 1 2019. Average Local State Sales Tax. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription.

Integrate Vertex seamlessly to the systems you already use. The Nebraska state sales and use tax rate is 55 055. Groceries are exempt from the Nebraska sales tax.

Sales Tax Rate Finder. Nebraska State Sales Tax. Sales and Use Taxes.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. The base state sales tax rate in Nebraska is 55. Counties and cities can charge an.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. This is the total of state county and city sales tax rates. The Ord Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Ord local sales taxesThe local sales tax consists of a 150 city sales tax.

Printable PDF Nebraska Sales Tax Datasheet. The Nebraska state sales and use tax rate is 55. The Nebraska NE state sales tax rate is currently 55.

Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825. Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the.

Nebraska sales tax details. 536 rows Nebraska Sales Tax55. Ad Be the First to Know when Nebraska Tax Developments Impact Your Business or Clients.

30 rows The state sales tax rate in Nebraska is 5500. Nebraska sales tax changes effective July 1 2019. Coleridge Nehawka and Wauneta will each levy a new.

This is the total of state county and city sales tax rates. What is the sales tax rate in Omaha Nebraska. NE Sales Tax Calculator.

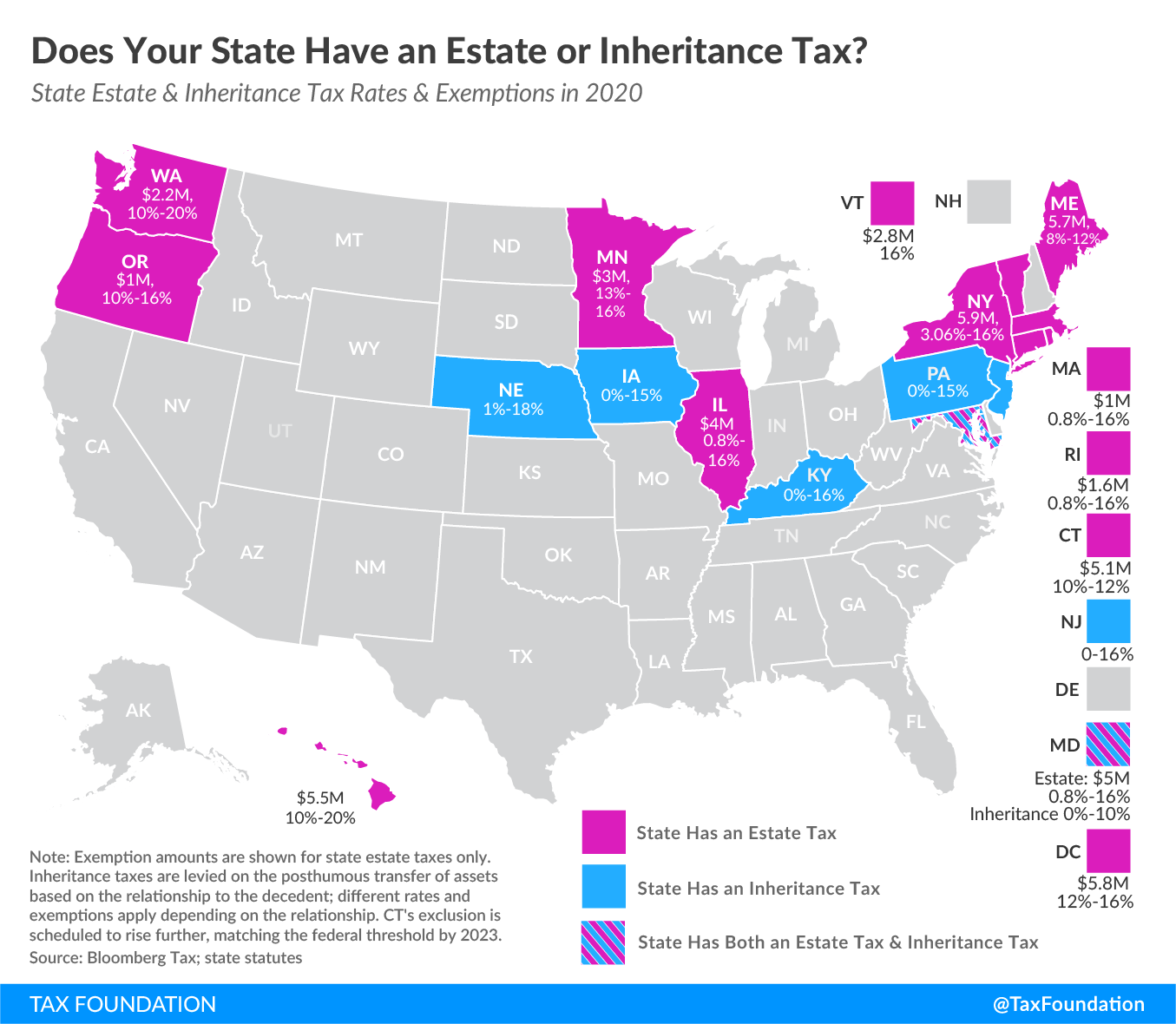

Don T Die In Nebraska How The County Inheritance Tax Works

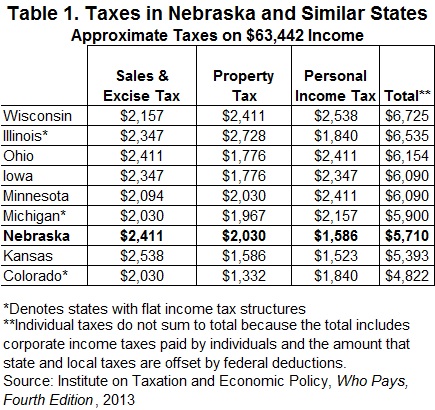

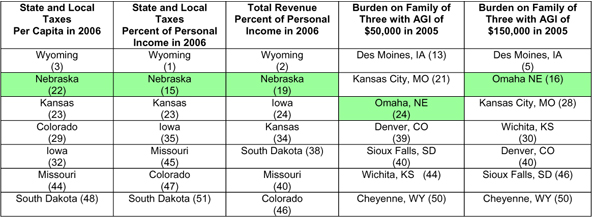

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Sales Tax On Grocery Items Taxjar

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

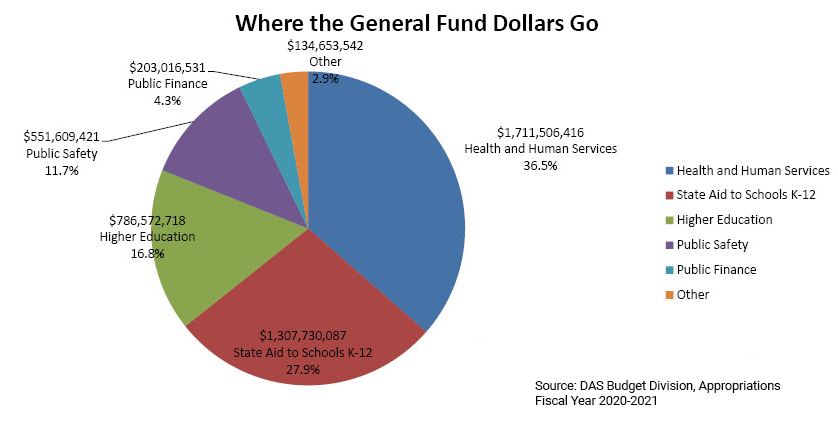

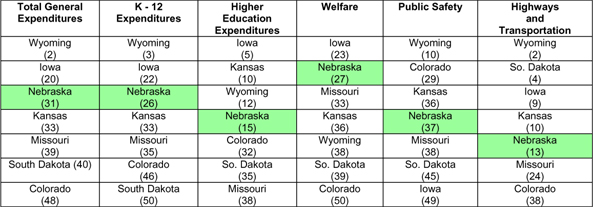

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Nebraska And Iowa Groups Call For Uniform Approach To Job Licensing

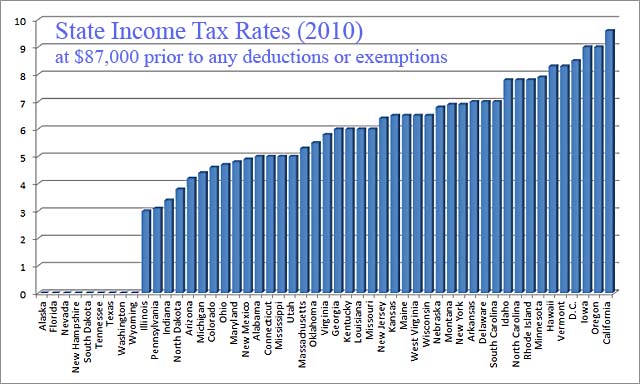

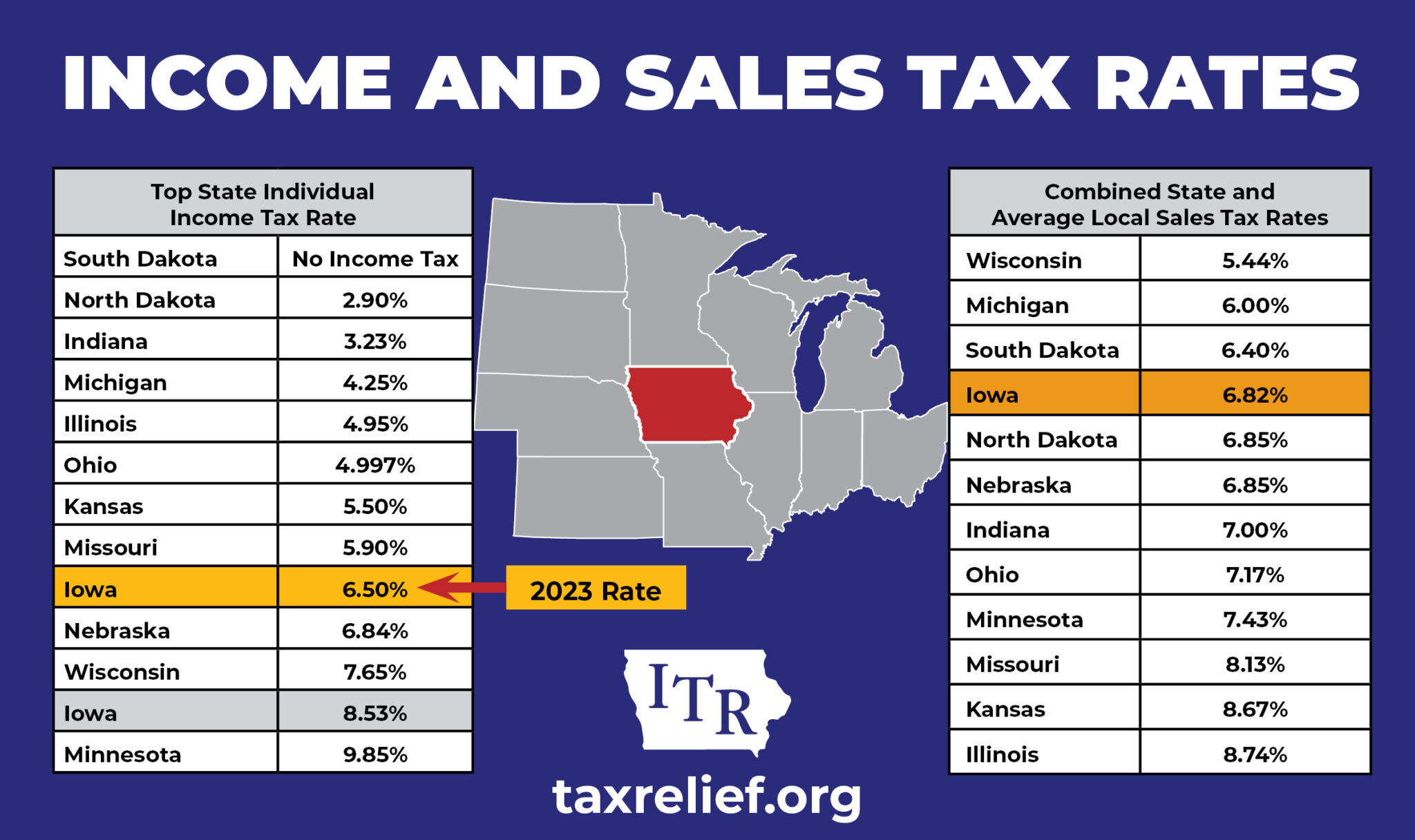

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

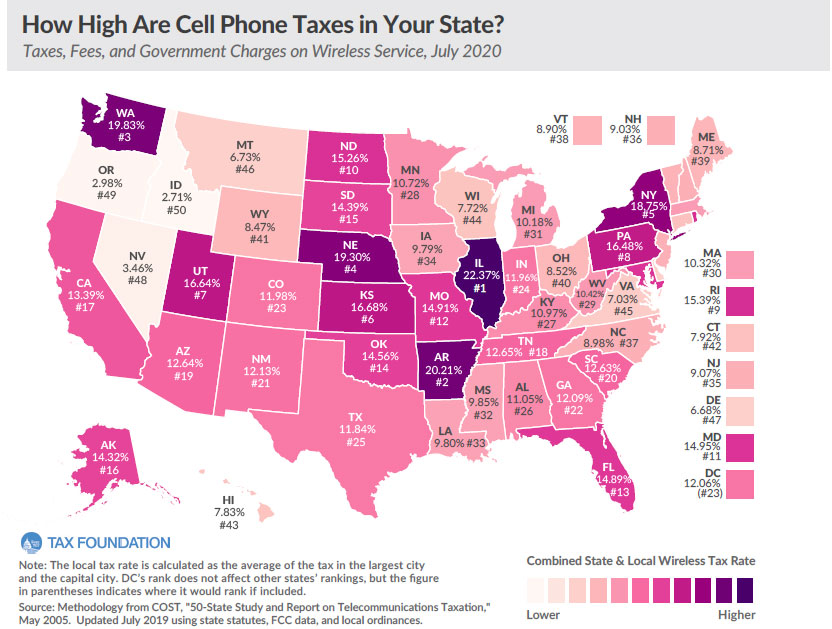

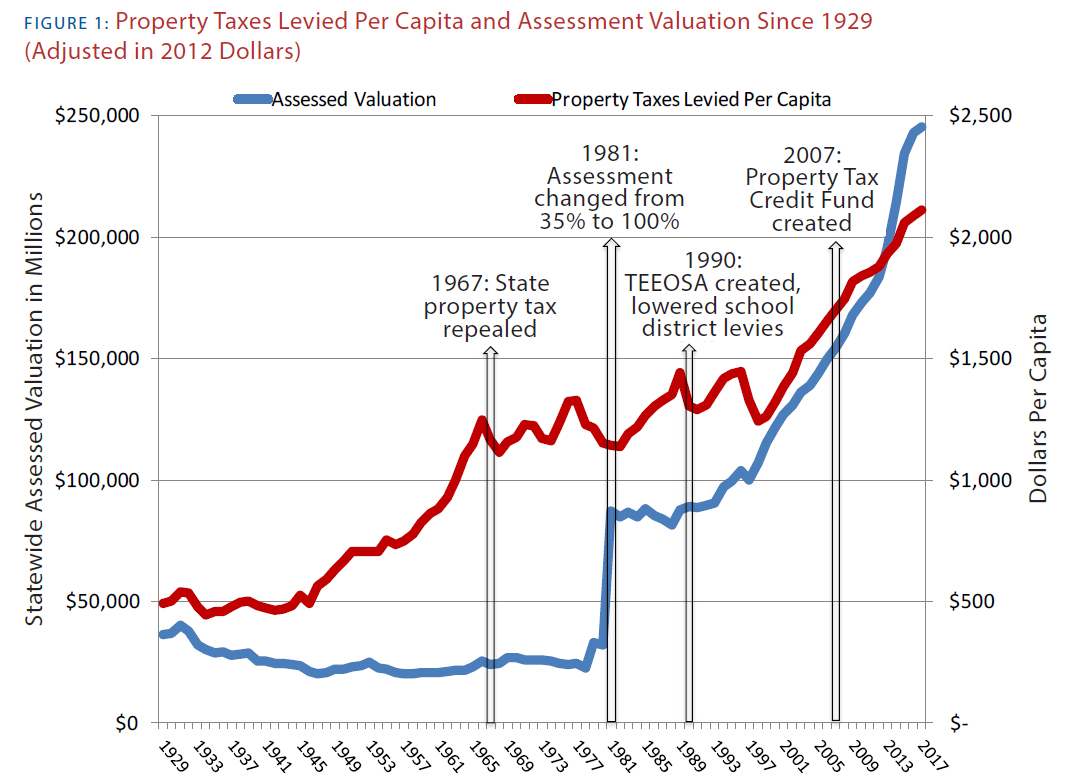

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

Taxes And Spending In Nebraska

Nebraska Sales Tax Rates By City County 2022

General Fund Receipts Nebraska Department Of Revenue

Get The Facts About Nebraska S High Tax Burden

Nebraska Sales Tax Small Business Guide Truic

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise